Blockchain technology has become more prevalent of its potential to give safe payments and reduce identity scams. A tremendous $18 billion is estimated in yearly blockchain technology spending, further with the financial sector giving approximately $523 billion to the overall amount.

So, what’s all the hype about? So, the ability to secretly store client information makes blockchain technology a preferred option for both users and service providers.

Identity scams are an increasing concern, with approximately 55 million people coming prey in the United States alone. Guess the size of stolen identities when increased at an international level.

Several are oblivious of the truth that their identities have been stolen unless they appear to see devastating results. Not having conventional means to guard user identity could cost online companies both brand integrity and company reputation.

Blockchain technology allows people greater authority over private data and a secure means of reducing identity scams.

What is Blockchain Technology?

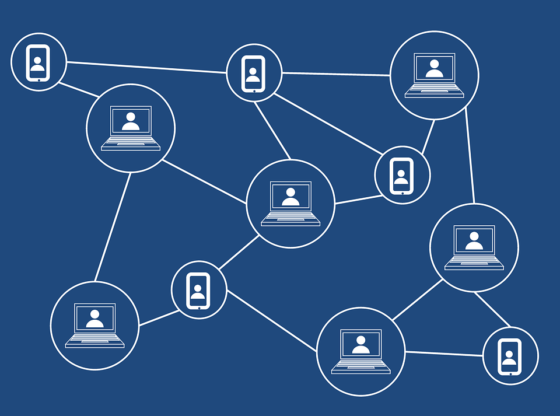

Blockchain technology is a combination of systems to gather user data, store it in encrypted information on various blocks on the internet. The blocks are information centers combined in a chain with each other employing cryptography – a technique to protect public transactions. A distributed ledger is liable for recording information against each payment in the chain.

Identity scams- a challenge for blockchain companies:

Usually, Identity scams take a price on users as well as pose a major threat to online companies. Fraudsters adopt a number of techniques involving data breaches, malicious activities, and debit/credit card fraud to continue their illegitimate motives.

Listed below are some of the most common situations of identity scams:

Synthetic Identity Scam

Synthetic Identity Fraud is the combination of users confidential information to create a false identity. Therefore, the procedure is carried out by blending the fabricated information with the stolen records of verified users.

Criminals use these new identities to conduct several other malicious activities. For example, online fraudsters setting up false accounts to correlate ties with online companies and performing money laundering through them.

E-commerce Fraud

Online shopping fraud is prevalent when buying items or services from online websites. Suspicious identities are all over these online websites to steal debit/credit card information by deceiving users into submitting their identity data. In other words, frausters uses formulated malicious emails and attractive proposals to steal user data

Medical Identity Fraud

Healthcare insurers and pharmaceutical service providers have to take precautions and keep a careful eye on intelligent criminals looking to acquire the medical history of patients.

Medical identity document scams can give illegitimate access to a patient’s record, which fraudsters can employ to acquire financial gains. This scam usually goes unrecognized due to a lack of proper identity verification devices during the enrolling of a patient and insurance applications.

Stolen Social Security Numbers

SSNs are a different road for buying identity scams. Usually, the social security number consists of 9 digits, and it contains birth date as identity proof

Criminals use SSN to perform a sequence of online scams involving healthcare and child identity scams. Usually, online fraudsters use SSN to acquire the innocent’s monetary data to create false accounts and obtain tax refunds.

Blockchain Technology on Reducing Identity Document Theft

Blockchain technology appears with a few benefits to guard client information and reduce fraudulent activities from gaining access to the system. Some of the few advantages are listed below:

Safe Channels for Payments

Blockchain technology can assist reduce personal information from getting in the hands of criminals due to the level of security it gives. The DLP in blockchain technology is a record-keeping record that holds online records.

A Cryptographic keys tool will protect the confidential data of client and encode in a user-friendly language. It makes it pretty difficult for criminals and money mules to break the keys and acquire personal information access.

For instance, if a fraudster gains access to the system; then the system will detect combat malicious activities in a few seconds and reduce potential damage.

With this technique, individuals of online services can conduct payments through a protected and safe channel without the worry of identity theft. DLP is combination of identity verification and KYC procedure. On the other hand it authenticate user identities across several websites.

Therefore to minimize the risk of end-point vulnerabilities and assists enterprises in following; secondly the standard laws for onboarding processes.

Personal information Ownership

Fraudsters use synthetic identities to open new accounts and issue the debit/credit cards for individual accounts so they can perform scams. This can happen in adverse credit scores, many debts on payment cards, and a red flag by monetary regulators.

Blockchain technology overcome from the problem of protected transaction by giving public keys.