Financial news offers more than stock and bond market information. It also offers currency exchange rates between the U.S. dollar and different foreign currencies, such as euro and British pound. Travelers overseas are not the only ones who need to know this information.

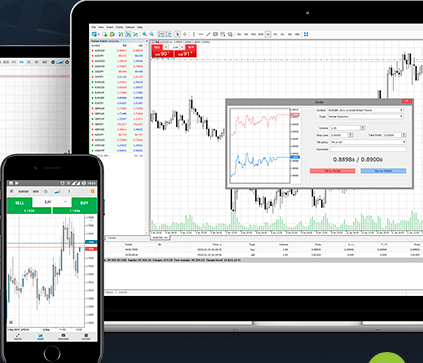

The purpose of foreign exchange traders is to profit from fluctuations in the market value of foreign currencies. It is possible to make tremendous profits on the foreign exchange market, but there may also be significant risks involved. Here are some tips for successful forex trading.

Forex Trading: What Is It?

The value of foreign currencies fluctuates daily. It is possible for traders to profit from any change in value, as long as they can capitalize on it. Forex transactions are highly liquid because they take place all the time. Investors are often surprised by the size of the Forex market, which is the biggest on Earth. A study by the 2019 Triennial Central Bank Survey estimates that FX and OTC derivative market participants exchange approximately $6.6 trillion per day on average. Trading volume on the New York Stock Exchange averages more than $1 trillion per day.

The Trading Forex Process

Like stocks, forex trading involves the purchase and sale of another type of security. Currency pairs such as EUR/USD (euro and U.S. dollar) and JPY/GBP (Japanese yen and British pound) are what make trading forex different. You buy one currency and sell another when you make a forex trade. When your foreign currency moves in favor of the one you sold, you profit.

A Guide To Learning Forex

A dynamic environment like the forex market calls for proper training. If you want consistent profits, regardless of your experience or knowledge of the market, you need to be prepared.

As easy as it may seem, it isn’t easy to accomplish. If you hope to succeed in forex, it is imperative that training never stops during the course of your job. A few of the ways to remain competitive in a fast-paced environment such as the Forex Online market include developing sound trading habits, attending expert webinars, and continuing your market education.

The goal of becoming a consistently profitable forex trader means that your education must never end. While the old adage says practice makes perfect, being prepared should be a routine part of the active trader’s routine even if perfection is difficult to obtain.

Is it beneficial to trade foreign exchange?

Forex offers a unique collection of benefits and drawbacks like any other market. Whenever a new forex trader enters the market, they must correctly investigate their options and determine whether it is a viable endeavor.

Traders of all types are attracted to the foreign exchange markets because they are remote, limit their capital requirements, and have low operational costs. In addition, trading forex is by far the largest marketplace, ensuring a consistent level of liquidity and depth. Provide a diverse array of products, and retail traders have a high level of strategic freedom.

Nevertheless, there are several pitfalls to watch out for. It can be hard to maintain discipline when one is faced with increased leverage and a great variety of trading options. Similarly, price volatility can be swift and dramatic, resulting in significant loss in a short period of time. Finally, past performance does not indicate future success, which is why good risk management and a solid strategy are essential for forex trading.

There are probably two biggest advantages to trading forex: flexibility and diversity. Traders have a wide range of options when it comes to opening a long or short position on several world-leading major, minor or exotic currencies.